Some aspects of homebuilding haven’t changed in decades, especially at the high-end of the market. Back in the early ’90s, as editor of Custom Builder magazine, I remember the horror stories of legally embattled builders. One wealthy client refused to pay a half-million dollar invoice because of a sticky door. Another demanded that every wall be torn out, when the faux-Italian wall surfacing didn’t meet her expectations. This kind of focus on aesthetics has been the norm at the high end for many years, but today’s builders face clientele who have reams of building science information available.

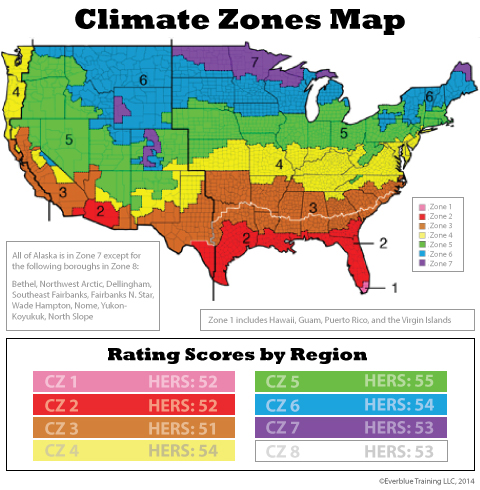

HERS Index ratings offer the possibility of comparing a new home’s predictive performance with that of nearby neighbors.

Who’s Buying Now?

The average sale price for a new house sold in January 2016 was $365,700, well beyond the means of a first-time buyer. (Source, U.S. Census). At the same time, the demand for secondary and vacation homes is booming. In 2014, for example, the National Association of Realtors 2015 Investment and Vacation Home Buyers Survey, showed that vacation-home sales (new and existing combined) hit about 1.13 million, the highest number since NAR began the survey in 2003.

So while some of the middle class is still shopping new homes, the new home buyer demographic skews wealthier, better educated and better informed than the average American. And studies have shown that higher income correlates with much greater use of the Internet, smartphones and other technology.

A couple of years ago, Google and the NAR did an analysis of how people shop online for new homes. They found that use of online searching has skyrocketed over the last few years. More recent research shows that reliance on the Internet declines by age group. The NAR reported that in 2015, “94 percent of millennials and 84 percent of baby boomers used online websites in their home search, only 65 percent of the Silent Generation—those ages 69 to 89 years—did the same. Older boomers, those aged 60 to 68 years, used a mobile device to search for properties at less than half the rate of millennials (30 percent versus 66 percent)”.Another interesting aspect of the digital home search is timing. Millennial buyers tend to spend 11 weeks researching before they buy. Older groups research less, and buy sooner.

What these numbers boil down to is a fundamental change in how homes are sold today. Instead of a “push” market, where builders call the shots, offer up a limited palette of designs and amenities, homeowners often come to the table with a detailed wish list of products, features and even floorplans.

The Search Pyramid: 1. Brand, 2. Category, 3. Everything Else.

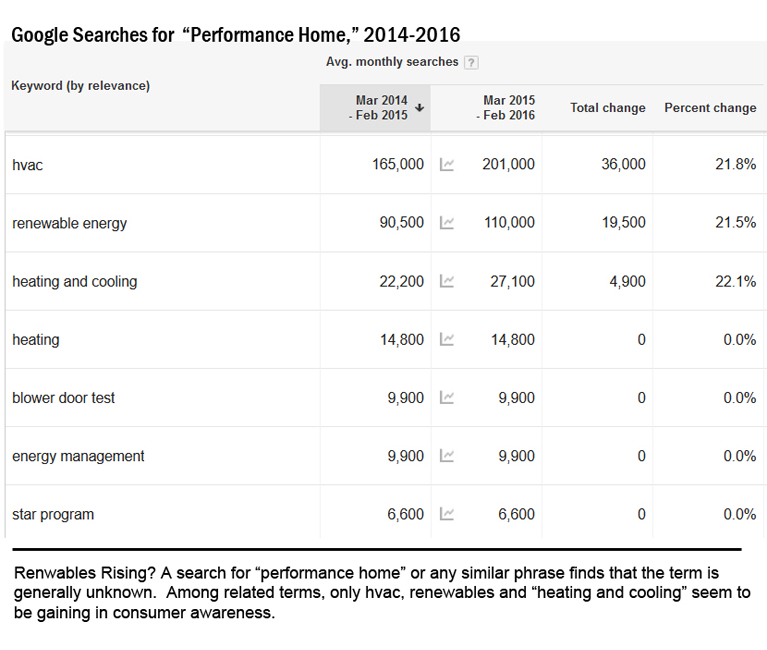

But just how “deep” does consumer knowledge go? We know (from search data) that cosmetic issues still dominate the conversation: square footage, countertop material, floors and finishes. But how much are buyers delving into behind-the-walls terms, such as HVAC performance, insulation, window quality or attic venting?

When we analyze Google keyword searches related to home construction, we find a distinct hierarchy of search density. The search begins with a precise product brand, proceeds to well-known categories of building materials, such as insulation, and quickly drops off from there into a few hundred searches a month for terms such as “house system” (590 searches a month with no growth in past 2 years).

Not to belabor the point, but consumer awareness of terms such as “performance home,” or “high-performance home” are almost never used in a search. That doesn’t mean these are “dead” terms, but rather that they have undeveloped potential for upward mobility. I’m not saying that to be flippant. We have found that when a term is unknown to search engines, it’s sometimes much easier to build it as a micro-brand that can attain the No. 1 SEO spot swiftly.

Brand recognition works like this. A consumer who’s open to new technology, looking for a wifi thermostat, doesn’t type in “wifi thermostat.” He or she types in “Honeywell wifi thermostat.” In fact, searches for these new thermostats exceed searches for the next four keyword groupings combined: “wireless thermostat”, “best thermostat” and “home thermostat”. That’s highly effective branding, sure, but it also reveals something deeper about consumer psychology with regard to home performance.

Beyond the “Magic Bullet” Perspective

The thermostat example suggests that smart buyers ARE looking deeper at home performance, but they see products as “magic bullets”—standalone solutions, not parts in a bigger system. This view persists, despite stoic efforts by manufacturers to educate and inform buyers about the importance of system thinking.

This lack of building science understanding in the consumer sphere may frustrate manufacturers, but it actually gives building professionals an opening. It means that there’s still a “gray area” in which trade pros can “push” toward better performance in the new home planning process.

By asking key questions, builders can steer a project toward higher performance and upgraded systems.

For example, in the case of insulation, the contractor might talk to the buyer about how insulation works in conjunction with window flashing, sill plates, caulking and sealants. Many manufacturers have this type of ready-made documentation available online. For example Owens Corning offers a step-by-step guide to “top of the roof” home insulation systems.